In Feb. 2016, Shenghua Biok's

acquisition plan of acquiring 100% of the shares in Blaze Loong Technology was rejected by CSRC, because the actual

controller of Shenghua Biok breached their commitment during the period June

2015-June 2016. Despite this, Shenghua Biok is likely to restart the

acquisition plan after June 2016.

On 19 Feb., 2016,

Zhejiang Shenghua Biok Biology Co., Ltd. (Shenghua Biok) announced that the

acquisition plan, namely Shenghua Biok acquiring 100% of shares in Chengdu

Blaze Loong Technology Co., Ltd (Blaze Loong Technology), was rejected by China

Securities Regulatory Commission (CSRC). CSRC revealed that the reason the

acquisition plan was rejected was because Shen Peijin, the actual controller of

Shenghua Biok breached its commitment to make no adjustment during the period

June 2015-June 2016. In actuality, Shen Peijin made big business adjustment

during that period, causing Shenghua Biok to fail in their attempt to

restructure.

According to CCM's

investigation, Shenghua Biok stated in June 2015 that their second largest

shareholder, Shen Peijin, had become the largest shareholder and actual

controller of Shenghua Biok, after the Shenghua Group reduced the shares it

held in Shenghua Biok by 10.89%. After that, Shen Peijin committed to making no

adjustment during June 2015-June 2016.

However, in Oct. 2015,

Shen Peijin actively promoted the acquisition plan. Blaze Loong Technology's

total assets were USD244.13 million (RMB1.6 billion) in 2014, accounting for

69% of Shenghua Biok's total assets. If successfully acquired, online gaming is

likely to become Shenghua Biok's main business. Shen Peijin is breaching his

commitment.

Currently, a slowdown in

Chinese economic growth, increasing burden from environmental protection and

product homogenization hinder the development of amino acid enterprises. They

are struggling to develop and are making sweeping transformations and reforms

in order to remain competitive and profitable in the overall industry.

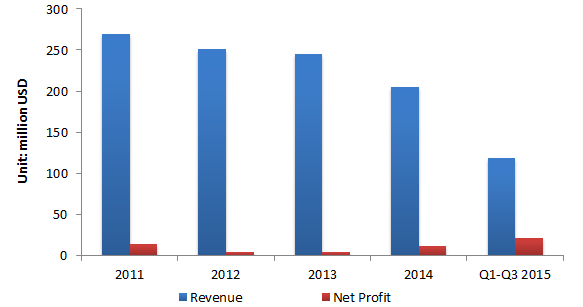

According to Shenghua Biok's annual report, between 2011 and 2014, the CAGRs of

its revenue was -9%. Pesticides and veterinary drugs accounted for 80% of the

company's total revenue, but less than 15% of their gross profit margin. In

addition, it was forced to drop the price of tryptophan due to intense market

competition. In 2015, the average market price of 98% tryptophan was

USD12,800/t, down by 33% YoY.

In order to turn losses

into gains, Shenghua Biok has taken the following measures:

Adjusting industrial

structure

The company has

increased investment in its highly profitable animal vaccine business and

divested unprofitable pesticide subsidiaries, Ningxia Gerui Fine Chemical Co.,

Ltd. and Inner Mongolia Biok Biology Co., Ltd.

Expanding business scope

The company has set foot

in unfamiliar new industries, such as online gaming, seeking new sources of

profit growth. The acquisition of Blaze Loong Technology is a key example. If

successfully, this will bring in more income for Shenghua Biok. In 2014 and H1

2015, Blaze Loong Technology achieved USD11.60 million (RMB76 million) and

USD5.19 million (RMB34 million) in net profit, respectively.

Shenghua Biok has made

preliminary achievements. It's estimated that 2015 net profit would grow by

50%-80% from USD12.65 million (RMB83 million) in 2014. Although the

company has made some achievements, it is not satisfied with that, and it will

take some other measures to further improve its business performance. CCM

believe that Shenghua Biok is likely to restart the plan to acquire Blaze Loong

Technology after June 2016.

CCM will follow up on

this company development.

Shenghua Biok's financial performance, 2011-2014 & Q1-Q3 2015

Source:

Zhejiang Shenghua Biok Biology Co., Ltd.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: Shenghua Biok